Hewlett Packard’s (HPE) purchase of Pachyderm to Boost AI Offerings

Hewlett Packard Enterprise HPE recently expanded its AI-at-scale solution portfolio with the acquisition of the San Francisco-based startup delivering software, based on open-source technology, to automate reproducible machine learning pipelines that target large-scale AI applications — Pachyderm. The buyout, which is anticipated to conclude in this month, stands on the company’s investment in Pachyderm through Hewlett Packard Pathfinder, to upscale time-to-market for AI innovation at reduced data processing and operating costs.

Pachyderm’s reproducible AI software improves HPE’s existing AI-at-scale offerings by efficiently maximizing machine learning initiatives of the data scientists, optimizing their infrastructure cost and ensuring that data is reliable and safe anywhere in the AI ecosystem. HPE’s AI-at-scale combines its leading supercomputing technologies that are foundational for optimized AI infrastructure, and the HPE Machine Learning Development Environment to aid enterprise users train more accurate AI models quickly and at scale, on several of the world’s fastest supercomputers purpose-built for demanding AI workloads.

Pachyderm Complements HPE’s AI-at-scale Portfolio

HPE integrates Pachyderm’s reproducible AI solutions in a single integrated platform to provide an advanced data-driven pipeline that automatically refines, prepares, tracks and manages repeatable machine learning processes which are used throughout the development and training environment. This will enable the company to quickly develop and deploy large-scale AI apps with benefits such as data versioning, data lineage and efficient incremental data processing.

HPE Machine Learning Development Environment, Pachyderm software and other solutions are integrated by Lockheed Martin’s open architecture approach to AI-at-scale, AI Factory. Pachyderm will be combined with the upcoming HPE Machine Learning Development System versions to reduce complexity and cost of developing and training models.

Currently, Pachyderm’s software is available for integration with HPE’s existing AI software solutions.

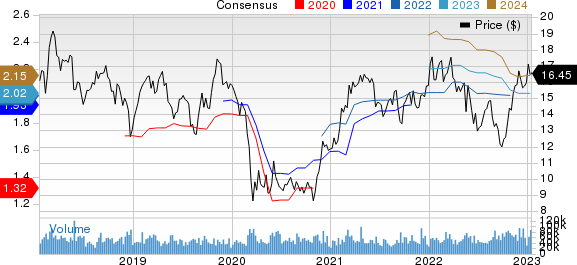

Hewlett Packard Enterprise Company Price and Consensus

Hewlett Packard Enterprise Company price-consensus-chart | Hewlett Packard Enterprise Company Quote

Hewlett Packard sees AI, Industrial Internet of Things, and distributed computing to be the next big markets. It is actively seeking acquisitions that will allow it to concentrate on high-margin hybrid IT model which combines on-premises computing with cloud computing. It acquired four businesses in 2021: Ampool, Zerto and Determined AI. This increased its capabilities and product portfolios within the rapidly growing cloud space, including software-defined networks, converged and hyperconverged infrastructure, and software-defined networks.

Strong executions in clearing backlogs and improving supply chain have helped HPE reap the benefits of increased customer acceptance. The company’s efforts to shift focus to higher-margin offerings like Intelligent Edge and Aruba Central Hyperconverged Infrastructure are aiding its bottom-line results. However, the company’s top-line growth is being hampered by execution issues in its Intelligent Edge segment.

Zacks Rank & Stocks to Consider

Hewlett Packard currently holds a Zacks #3 (Hold) rank. HPE shares plunged 6.3% over the past year.

Here are some top-ranked stocks within the Computer and Technology sector. Bandwidth BAND, Clearfield CLFD Zscaler ZS. ZS. You can also see Here’s the complete list of Zacks #1 Rank stocks today.

The Zacks Consensus Estimate for Bandwidth’s fourth-quarter 2022 earnings has been revised by a penny to 4 cents per share over the past 60 days. In the last 30 days, earnings estimates for 2022 moved northward by 25 cents and 37 cents per shares.

BAND’s earnings beat Zacks Consensus Estimates in all four of its trailing quarters. The average surprise was 301.8%. The shares of the company fell 65.3% over the past year.

Clearfield’s first-quarter fiscal 2020 earnings estimates have been revised by 15 cents to $1.02 per share. This revision was made over 60 days. In fiscal 2023, earnings expectations have increased by 37.5% to $4.95 a share in the last 60 days.

CLFD’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 39.7%. In the last year, shares of the company rose by 20.6%.

The Zacks Consensus estimate for Zscaler’s first-quarter fiscal 2023 earnings was revised 3 cents north at 29 cents per share in the last 30 days. Earnings estimates for fiscal 2023 have increased by 6 cents to $1.23 a share over the past 30 days.

ZS’ earnings beat Zacks Consensus Estimates in all four trailing quarters, with an average surprise of 28.6%. The shares of the company fell 57.8% over the past year.

Get the most recent Zacks Investment Research recommendations. Download 7 Best Stocks in the Next 30 Days Today Click to get this free report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

Bandwidth Inc. (BAND) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report