Institutional investors should be happy with a 4.6% increase last week which adds to Arcadis NV’s (AMS:ARCAD), one-year returns

Take a look at Arcadis NV’s shareholders (AMS:ARCADThis can reveal which group is most powerful. The institution with 56% ownership holds the largest share of the company. The group is likely to profit the most or lose the least from their investment in the company.

And things are looking up for institutional investors after the company gained €158m in market cap last week. The company’s gains last week would have boosted its one-year return on shareholders to 7.4%.

The chart below shows the various ownership groups of Arcadis.

View our latest analysis for Arcadis

What does the Institutional Ownership tell us about Arcadis

Institutional investors frequently compare their returns with those of a common index. They may consider buying larger companies that are in the relevant benchmark index.

Arcadis has institutional investors. This is a significant part of Arcadis’ stock. This could indicate that the company is trusted by the investment community. Be wary of relying upon institutional investors for validation. They also sometimes make mistakes. It’s not unusual to see a large share price decline if two large institutional buyers try to sell out of a stock simultaneously. It is worth looking at the Arcadis earnings history (below). Remember that there are other factors as well.

Note that institutions can own more than half of the company and have significant collective power. We are surprised to see that Arcadis is not a viable investment for hedge funds. We can see that Stichting Lovinklaan is the largest shareholder with 18% of outstanding shares. Stichting Pensioenfonds ABP, which owns 10% of the common stock, is the second largest shareholder. BNPP Asset Management Holding controls 4.4%.

Further inspection revealed that more than half of the shares were owned by the top nine shareholders. This suggests that the larger shareholders have a greater share of the company’s stock.

Although studying institutional ownership can be a valuable addition to your research, it’s also a good idea to study analyst recommendations to gain a better understanding of the stock’s expected performance. The stock is covered by some analysts, but this could change over time.

Insider Ownership Of Arcadis

Although it is difficult to define what constitutes an insider, nearly everyone agrees that board members are insiders. The board ultimately answers to management. Managers can be members of the executive board, particularly if they are founders or CEOs.

Insider ownership is generally something I consider a positive thing. Sometimes, it can make it harder for other shareholders hold the board accountable for their decisions.

The most recent data shows that insiders hold shares in Arcadis NV. The insiders have a meaningful stake worth €60m. This would be a significant positive for most. This level of insider investment is a good thing. You can check here to see if those insiders have been buying recently.

General Public Ownership

A 24% stake is held by the general public, which are typically individual investors. Even though this ownership is substantial, it may not be enough for a company to make changes in policy if the decision does not align with other large shareholders.

Private Company Ownership

Our data shows that 18% of shares are held by private companies. Private companies could be related. Insiders may have an interest in public companies through a holding in private companies, rather than as individuals. Although it’s not possible to draw general conclusions, it is something worth considering as a topic for further research.

Next steps:

It is important to consider the various owners of a company. However, there are more important factors.

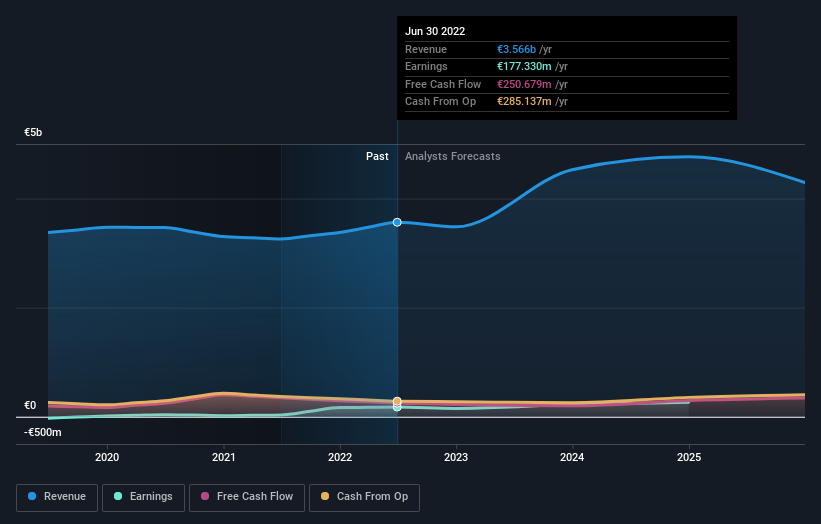

I like to dive deeper You can see how the company performed in the past. Access the data here this interactive graph of past earnings, revenue and cash flow, for free.

Let’s hope it all works out. Future is important. This is how you can get it. No cost report on analyst forecasts for the company.

NB. The figures in this article are based on data from the past twelve months. These refer to the 12-month period ending with the month that the financial statement was dated. This could not be consistent with full-year annual report figures.

Let us know what you think about this article. Are you concerned about the content? Get in touch Contact us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St has a general nature. We only provide commentary on historical data and analyst projections. Our articles are not meant to be considered financial advice. This analysis does not represent a recommendation to purchase or sell any stock and it does not consider your financial goals or financial situation. Our aim is to give you long-term, data-driven analysis. Please note that our analysis might not include the most recent announcements from price-sensitive companies or qualitative material. Simply Wall St does not hold any position in the stocks mentioned.

Participate in a Paid User Research Session

You’ll receive a Amazon Gift Card: US$30 Give us 1 hour of your time and help us create better investing tools for individual investors like you. Sign up here