Is it now the right time to add AJ Bell (LON AJB) to your watchlist?

It can be tempting for beginners to invest in a company that has a compelling story to tell investors. Peter Lynch said it in One Up on Wall Street“Long shots almost never pay off.” Loss-making companies are yet to show their worth with profits, and eventually external capital might dry up.

If this is not your type of company, but you are interested in companies that earn revenue, and even profits, then you may be interested in AJ Bell (LON:AJB). Profit is not the only metric to be considered when investing. However, it’s important to recognize businesses that consistently produce it.

See our latest analysis for AJ Bell

How fast is AJ Bell growing?

The market is a voting device in the short-term, but a weighing system in the long-term. Therefore, you would expect that share price will eventually follow earnings per share (EPS). EPS growth is a positive indicator for long-term investors who have been successful. Over the course of three years, AJ Bell managed a 15% increase in EPS. This is a good growth rate, provided that the company can maintain it.

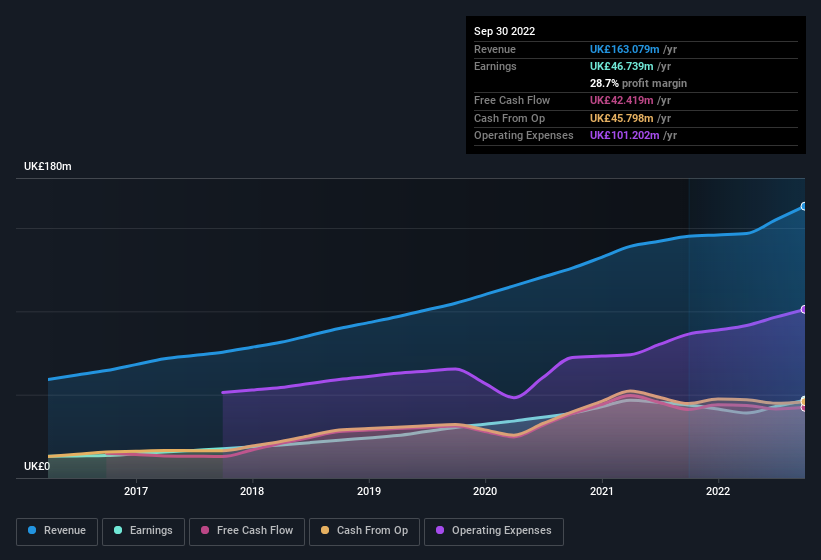

Top-line growth is a great indicator of growth that is sustainable. It is combined with an excellent earnings before interest taxation (EBIT), margin it is a great way to keep a company competitive in the market. EBIT margins for AJ Bell remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to UK£163m. This is encouraging news for the company.

Below is the chart showing how the company’s bottom and top line have developed over time. Click on the image to see more details.

The future is more important than the past when it comes to investing and life. Check out this article. No cost interactive visualization of AJ Bell’s forecast profits?

Are AJ Bell Insiders Aligned with All Shareholders

Insiders who also own shares in the company should provide investors with a sense security. This will allow them to feel more secure and align their interests. It is encouraging to see that AJ Bell insiders have a substantial amount of capital invested into the stock. We note that their impressive stake in the company is worth UK£355m. This equates to 24%, which makes insiders powerful and aligned. This is very encouraging.

It is encouraging to see that insiders have invested in the company. But are the remuneration rates reasonable? Based on CEO pay, it would seem that they are. Our analysis has discovered that the median total compensation for the CEOs of companies like AJ Bell with market caps between UK£821m and UK£2.6b is about UK£1.8m.

AJ Bell’s CEO took home a total compensation package of UK£635k in the year prior to September 2022. It’s clear that this is a very low level of compensation. However, it does indicate that the company has a modest culture of remuneration. While CEO compensation shouldn’t be the main factor in how the company will be viewed, modest remuneration can be a positive because it shows that the board considers shareholder interests. There are arguments that reasonable pay levels can attest to good decision making.

Is it a good idea to add AJ Bell as a watchlist member?

As I mentioned previously, AJ Bell is a rapidly growing company which is positive. AJ Bell’s growth in EPS is the headline, but there are more things that will bring joy to shareholders. You’d argue that this company is worth your attention, with its modest CEO pay and significant insider ownership. You must still consider the ever-present risk of investing. We’ve identified 2 warning signs with AJ Bell Understanding these factors should be part your investment process.

You can always make money by buying stocks. They are not Increasing earnings do not share buying by insiders For those who value these important metrics, we recommend that you check out companies. Do These features are included. These features are available to you. a free list of them here.

Note that insider transactions are only reported transactions in the applicable jurisdiction.

Give feedback about this article Are you concerned about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article is by Simply Wall St. It is general in nature. We only provide commentary on historical data and analyst projections. Our articles are not meant to be considered financial advice. This analysis does not represent a recommendation to purchase or sell any stock and it does not consider your financial goals or financial situation. We strive to deliver long-term focused analysis that is based on fundamental data. Our analysis may not take into account the most recent price-sensitive company announcements and qualitative material. Simply Wall St does not hold any position in the stocks mentioned.

Register for a paid user research session

You’ll receive a Amazon Gift Card – US$30 Give us 1 hour of your time and help us create better investing tools for individual investors like you. Sign up here