Investors Holding Back On MMS Ventures Berhad (KLSE:MMSV)

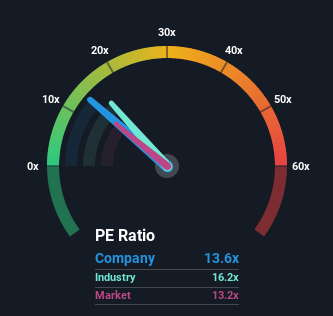

Malaysia’s median price-to–earnings ratio, or “P/E”, is close to 13x. This could make it easy for you to feel indifferent. MMS Ventures Berhad’s (KLSE:MMSV) P/E ratio of 13.6x. Investors might overlook a clear opportunity, or a potential setback, if there’s no rational basis for the P/E.

MMS Ventures Berhad is doing an excellent job lately. It’s been increasing earnings at a rapid pace. The P/E has remained stable because many people are expecting the strong earnings performance to fade. You might like the company and wish this wasn’t true so you can potentially buy stock when it’s not in favor.

Check out our latest analysis for MMS Ventures Berhad

Do you want to see the whole picture of earnings, revenue, and cash flow for your company? Check out our company report. free report on MMS Ventures Berhad It will allow you to shine a light upon its historic performance.

Is Growth a Match for the P/E?

For P/E ratios, such as MMS Ventures Berhad’s, to be reasonable, a company must match the market.

The company’s earnings growth in the past year was 34%. EPS has risen 82% overall from three years ago thanks to the growth of the last twelve months. This is a wonderful development. These medium-term earnings growth rates would have been welcomed by shareholders.

This is in contrast with the rest the market which is expected to grow at 8.7% over next year. This is materially lower that the company’s previous medium-term annualised rates of growth.

This information makes it very interesting that MMS Ventures Berhad trades at an almost identical P/E as the market. It is possible that many investors aren’t sure the company can keep its recent growth rates.

What can we learn from MMS Ventures Berhad’s P/E?

We would say that the price to earnings ratio’s power doesn’t serve as a valuation instrument, but rather serves to gauge investor sentiments and future expectations.

MMS Ventures Berhad’s earnings trends over the past three years are not contributing as much to its P/E. This is despite them looking better than current market expectations. We assume that potential risks could be putting pressure on the ratio when we see strong earnings and faster than market growth. The risk of a price decline appears to be minimal if the current medium-term earnings trends are maintained, but investors believe future earnings may see some volatility.

It is important to always consider the ever-present possibility of investment risk. We’ve identified 4 warning signs with MMS Ventures Berhad There are at least one that is somewhat unpleasant, and you should consider these when making investments.

If you’re looking to Uncertain about MMS Ventures Berhad’s strengthWhy not explore? our interactive list of stocks with solid business fundamentals For any other companies that you might have missed.

Let us know what you think about this article. Are you concerned about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article is by Simply Wall St. It is general in nature. Our commentary is based on historical data, analyst forecasts and other unbiased information. We do not intend to provide financial advice. This analysis does not represent a recommendation to purchase or sell any stock and it does not consider your financial goals or financial situation. We strive to deliver long-term, focused analysis that is based on fundamental data. Our analysis may not take into account the most recent price-sensitive company announcements and qualitative material. Simply Wall St does not hold any position in the stocks mentioned.

Participate in a Paid User Research Session

You’ll receive a Amazon Gift Card – US$30 Give us 1 hour of your time and help us create better investing tools for individual investors like you. Sign up here