Techbond Group Berhad, KLSE:TECHBND), Might Be Struggling To Allocate Capital

There are often underlying trends that can help us find potential multi-baggers. Try to find a company that has these characteristics. Returns On capital employed (ROCE), which are growing, in combination with a growing Sum The amount of capital used. This shows that the business is investing profits at an increasing rate of return. We don’t believe the numbers are accurate after a quick review. Techbond Group Berhad (KLSE:TECHBNDThe potential to become a multi-bagger is there for ), but let’s look at the reasons why.

What is Return on Capital Employed?

ROCE stands for Return on Capital Employed. It measures the pre-tax profits that a company can make from its capital. Techbond Group Berhad’s formula is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.051 = RM8.4m ÷ (RM172m – RM5.8m) Based on the trailing 12 months up to September 2022.

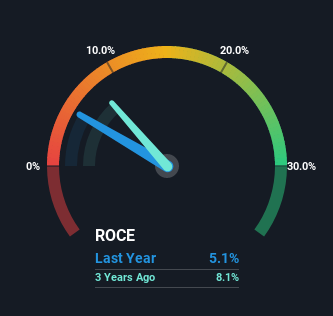

Therefore, Techbond Group Berhad boasts a ROCE of 5.1%. Absolute terms, it’s a low return. It also falls below the 8.0% industry average.

See our latest analysis for Techbond Group Berhad

If you are looking for historical performance, it is a good place to start. You can see Techbond Group Berhad’s ROCE and compare it with its previous returns. These are the links to explore Techbond Group Berhad’s historical earnings, revenue, and cash flow. Free graphs here.

What Can Techbond Group Berhad’s Roce Trend Tell Us?

Techbond Group Berhad’s ROCE historical movements don’t look great. The returns on capital have declined to 5.1% over the past five years from 23% five year ago. The business appears to be pursuing growth, despite the fact that revenue and capital have increased. This can be a boon for stock performance in the long-term if these investments are successful.

Techbond Group Berhad’s ROCE: The Bottom Line

We are encouraged to see that Techbond Group Berhad is investing for growth, even though it has lower short-term returns. The stock has gained only 7.0% in the past three years. This stock could still be a good investment opportunity if the fundamentals are sound.

Techbond Group Berhad is not without risks. We’ve seen them. 1 warning sign for Techbond Group Berhad These are some of the things you might be interested.

For those who want to invest solid companies, Check out this Free list of companies with solid balance sheets and high returns on equity.

Let us know what you think about this article. Have a question about the content? Get in touch Contact us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St has a general nature. We only provide commentary on historical data and analyst projections. Our articles are not meant to be considered financial advice. This analysis does not represent a recommendation to purchase or sell any stock and it does not consider your financial goals or financial situation. We strive to deliver long-term, grounded analysis that is based on fundamental data. Please note that our analysis might not include the most recent announcements from price-sensitive companies or qualitative material. Simply Wall St holds no position in any of the stocks mentioned.

Register for a paid user research session

You’ll receive a Amazon Gift Card – US$30 Spend an hour helping us to create better tools for individual investors. Sign up here